Meredith Salita, Realtor®

Thoughts on Real Estate

Monday, February 10, 2025

Luxury Listing in North Potomac

13818 Hidden Glen Lane

Monday, September 23, 2024

Changes to Landlord Responsibilities - HB 693

Understanding Key Changes in Landlord Responsibilities: HB 693

If you own or are considering owning investment property for rent, it is crucial to stay informed about the legal landscape of landlord-tenant relationships. On October 1, significant changes will take effect as outlined in the recent legislative document, HB 693. These updates impact how landlords must interact with tenants, especially when planning to sell their properties. Here's a breakdown of the key changes every landlord needs to know:

Key Changes to Landlord Responsibilities:

1. Planning to Sell Your Property?

- Notice of Sale:

Landlords will now be required to provide a written notice of sale to the tenant, offering them the option to purchase the property. The tenant has 30 days to respond to this offer before you can list the property on the public market. - Right of First Refusal:

If the tenant has not accepted the offer to purchase and the owner has received and intends to accept a third-party offer - if that offer is 10% or more lower than the price previously offered to the tenant, tenants now have the right of first refusal. This means they can purchase the residential rental property by matching the terms of the third-party offer. (If the tenant's offer matches, the landlord must accept it.) - Counteroffers:

If the tenant's initial offer deviates from the terms of the third-party offer, the landlord must provide a counteroffer within five days. The tenant then has another five days to accept or reject the counteroffer. - Documentation:

The notice of sale and any notice of third-party offers must include the sales price offered by the third party, and a copy must be sent to the Office of Tenant Legal Assistance (OTLA).

2. Limitations and Exemptions:

- Exempt Transfers:

The right of first refusal does not apply to certain transfers, such as those to family members, business entities wholly owned by the owner, court-ordered transfers, transfers by fiduciaries, or transfers to government entities. - Waivers and Assignments:

Any attempted waiver or assignment of the tenant's right of first refusal is void. Tenants cannot waive their rights under this provision.

3. Penalties for Non-compliance:

- Landlords who fail to comply with these provisions may be fined up to $1,000 per violation.

Stay Informed and Compliant

As a landlord, staying informed about current laws and regulations is essential. Consider hiring a reputable property management company to ensure compliance and avoid costly fines. These professionals can help navigate the complexities of landlord-tenant laws and ensure all legal responsibilities are met.

For more detailed information, refer to the full legislative document, HB 693, and keep your rental operations compliant and fair for all parties involved, and as always, feel free to reach out if you have any questions on how this might affect your own personal scenario.

Wednesday, August 14, 2024

The Costs of Buying a Home

If you have never purchased a home before, there are a lot of things you probably do not know about the process. Beyond finding that home on your favorite real estate app, what does it actually take to go from scrolling through pictures and daydreaming to getting the keys and moving in?

Sales Price

The one thing everyone sees is the sales price - this is probably something you have even used to put a filter on your search. In different markets, this number may be anywhere to close to what the home sells for, or significantly different. The important thing about this number is that it is determined by the seller. Sure, they may have had a listing agent run data from the neighborhood and give advice on that price, but the sales price is always set by the seller. In the last few years, the sales price listed on a property has often been referred to as the "starting offer" as homes can escalate above list price. As things have settled down a bit, that sales price is closer to reality. In the last month (July '24) the average sold price was 102% of the list price, and yet we are still having instances of intense competition - the highest percent over list price for July was 187%.

Financing

Ok, you've found the home of your dreams, how are you going to pay for it? Have you spoken to a lender? Found out what you can borrow? What are the current rates? What kind of programs do they have that may save you money or allow you to move forward? What amount of money do you have saved up for the downpayment? Do you need a downpayment? There are programs for very low downpayments (and VA loans with $0 downpayment) but of course, as I'm sure you know, the less you borrow, the lower your mortgage payments will be. The lending process can be very convoluted, and talking to an experienced lender who can explain everything to you early on will make a huge difference in your home buying experience.

Wait, that's not all - You Need More Money

You don't just need a downpayment to purchase a house, you also need to pay the professionals who provide valuable services to you along the way. The Lender, your Agent, the Home Inspector(s), the Title Company, the HOA if there is one, Insurance... oh, and the Government too. Property, Transfer and Recordation taxes owed to the government along with these other services will all depend on where you are purchasing and are based on the value of the home. These fees (minus any inspections - which are paid at the time of service) will add together to make up what is called "Closing Costs" i.e. the money that needs to be brought to the table on closing day when you take ownership of the home. The Lender and your agent can help you to estimate what these costs will be once you have a budget for your dream home. After closing you'll have movers and utilities to set up, and maybe you've decided to do some work to the home before you move in. All things to consider when saving that nest egg.

Your Guide Through It All

Your real estate agent acts as a sort of "GC" for the buying process. An experienced agent will have references for good vendors for lending, for home inspectors, for contractors, for moving, for title work - vendors they have worked with before and trust to do a good job. This knowledge alone is invaluable and can save you time, energy and stress. They can also be your "concierge service" - your first call when you have a question. Even though a real estate agent isn't a lawyer, lender or a home inspector, they will know where to get the answers you need, whatever your questions may be. A good agent is going to get you through the buying process smoothly and educate you with the knowledge you need to make confident decisions. Your agent's compensation is negotiated when you sign the required-by-law buyers agreement - a document that officially hires an agent to work for you as your personal representative and fiduciary. This document lays out protections for buyers and also for agents, it has a beginning and extendable end date, and it specifies how your agent will be paid for their service.

How much does Agent Representation Cost?

It varies. I can tell you how much I personally charge for my services, but agents are people with varying skills and varying services. There are discount services who will not be all that I described above - they won't be there for your every call and question and you will be on your own to navigate much of the process that lies outside of showings and writing offers. In fact, you can even choose to be on your own to find homes that fit your needs and write an offer completely unrepresented "fill in the blank" style - no guidance, no explanations of what you are signing - if you so choose. The recent lawsuits against various Real Estate Associations were heavily focused on buyer agent fees and transparency. Here in Maryland, we have had buyer representation and buyer agreements that protect buyers and explain representation for decades, but in some areas of the country, they have only just been mandated to start using buyer agreements as a result of the lawsuits.

Another result of the lawsuit is to make sure that everyone knows that compensation is negotiable. That doesn't mean agents can't dictate what they charge for their services, it just means it's negotiable. An article came out in the last week that suggested that buyers should not pay more than 2% to their agent and the industry was left wondering where they got that number, what they were considering when coming up with what fair compensation might be for a real estate agent who has worked with a client for multiple years looking for that perfect home. Have they taken into consideration the years of knowledge and experience a buyer might have access to, the monetary benefits of access to vendors who have been vetted for their professionalism and quality of work? What about the value of having someone who will answer your text at 8pm on a Thursday or 2pm on a Sunday to set your mind at ease about some question that just popped into your head? What other business holds these kinds of working hours? I get a daily e-mail from the singular Leonard Steinberg of Compass and today's message had his own opinion on this very article which in return prompted me to write today's blog. Here is a blurb from his e-mail as food for thought.

"

"

If you or someone you know is thinking about buying or selling property in Maryland or Northern VA, reach out anytime for a free consultation.

Monday, March 25, 2024

Misinformation and Clarification on the NAR news

Are you curious about the recent developments regarding the NAR lawsuit? Let me shed some light on this matter from inside my world of Real Estate.

The National Association of Realtors, along with several other brokerages, including Compass, has reached a settlement in this lawsuit. However, it's important to mention that the court's approval of the settlement is pending, a process that may take several months and could potentially lead to changes in the terms of the settlement.

First and foremost, it's crucial to understand that this lawsuit revolves around the principle of transparency within real estate transactions. It aims to ensure that all parties involved are fully aware of how agents are compensated for their services and hard work.

In the most common scenario, sellers compensate their listing agents and extend an offer of compensation to the agent representing the buyer. This arrangement is designed to accommodate buyers who often allocate most if not all of their financial resources towards their down payment, securing a loan, and covering other expenses associated with purchasing a home. This "accommodation" benefits both buyers and sellers as buyers who cannot afford adding to these homebuying costs may choose not to make an offer on a seller's property or even consider it if they also have to pay this additional fee.

Imagine this scenario: A Seller has decided against offering any compensation to Buyer's agents when listing their property for sale. The buyer's agent informs their client that if they are interested in this property, they will need to budget for the additional cost of covering their fee. The seller's decision has effectively shrunk their potential buyer pool by causing some buyers to decide against seeing the home altogether, understanding that they will have this additional cost at closing. This results in fewer buyers viewing the home. The seller gets an offer from a buyer who has decided to move forward. The buyer writes into the contract as a condition of their offer that the seller will pay the buyer's agents compensation as "seller help". So after shrinking their buyer pool, reducing competition for their property, and as a result possibly not getting the best offer, they are now being asked to pay the compensation in the end anyway. Clearing the path of potential obstacles for buyers from the start guarantees that a seller will get the most offers and best price possible. After all that, I'd also like to twist your perspective here: in most cases, these agent fees are paid at the closing table out of the proceeds from the sale - unless the seller is upside-down on their mortgage and is selling the property for less than they owe (where the sale of the property won't cover all the closing costs), the money that is paying for everything - the house, the closing costs, and the agent fees, is actually coming from the buyer already!! When marketing your home for sale, it is important to be competitive with the local market. Just as you would look to the price a neighborhood home sold for, you would also take into consideration the concessions a seller has made in that sale. If you have ever had a CMA "Comparative Market Analysis" done for your house, you would know we don't just look at the final sales price of your neighbors and call it a day.

One significant aspect of this lawsuit is the revelation that many home sellers were unaware of their ability to offer varying compensation to buyer agents. This case serves to bring clarity to sellers across the United States regarding their options in this regard.

Agent compensation should always be disclosed at the outset and this is accomplished with the Agency Agreement. It's noteworthy that only 14 states in the country currently have buyer agency agreements in place. Maryland however is one of the 14 and has had buyer agency for over two decades, so while this will be a significant change for many, it is not a change for us here in the DMV. Our buyer agency agreement has and will continue to spell out how buyer agents are compensated and this will not change. One of the outcomes of this lawsuit is the implication that the remaining states will need to adopt buyer agency to enhance transparency in real estate transactions regarding how buyer agents are compensated. This is a good thing for buyers and for also agents across the country.

According to the settlement agreement, effective from July 2024, NAR-affiliated multiple listing services will no longer state what the seller contribution is towards buyer's agent compensation within their system. Consequently, buyer’s agents will be required to directly contact the listing agent to ascertain if compensation is being offered. Buyers also have the option to directly compensate their broker or negotiate for the seller to cover these costs at the time of making an offer. In addition, listings accessible to buyer’s agents cannot be sorted based on the buyer broker commission offered. In our market, buyer agent compensation is already not a sortable field within our multiple listing service so this is not something that has been practiced locally by agents using the MLS. Rest assured, we are committed to providing you with information on all properties that align with your needs and preferences.

Real Estate agents do not work for free. Buyers who are about to participate in one of the largest transactions of their lives should demand representation for their protection and at the same time should expect that those fiduciary duties and that representation on their behalf has fees associated with it. Real estate agents will be mandated to fully disclose that commissions are negotiable and not dictated by law. Clients must also be informed that agent services come at a cost. These are practices that reputable agents have been adhering to for years. Additionally, by law, agents will need to obtain a signed agreement before showing property to a buyer, ensuring transparency and clarity from the outset. A large portion of the population starts their search online before ever contacting an agent, so if you are starting your search to purchase property - find the agent you want representing you and sit down for that consultation right at the start. That way, when you find what you are looking for, you are ready to go with a plan to move forward.

Should you have any inquiries regarding these developments or any other aspect of the real estate process, please do not hesitate to reach out. I am here to assist you every step of the way.

Friday, March 15, 2024

Thursday, February 22, 2024

Falling Rates for the Spring Market?

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year

In every conversation I have, it seems I end up discussing current mortgage rates and how it is influencing the market. One of the things I tell people to consider though is how lower rates tend to increase competition, which can change sales price. So when is the best time to buy a house?? When you find the one you want.

Still, mortgage rates are a topic of conversation so let's go there. There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last fall, mortgage rates have trended down overall.

And if you’re looking to buy or sell a home, this is a big deal. While they’re going to continue to bounce around a bit based on various economic drivers (like inflation and reactions to the consumer price index, or CPI), don’t let the short-term volatility distract you. The experts agree the overarching downward trend should continue this year.

While I don't believe we will see the record-low rates homebuyers got during the pandemic, some experts think we should see rates dip below 6% later this year. As Dean Baker, Senior Economist, Center for Economic Research, says:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

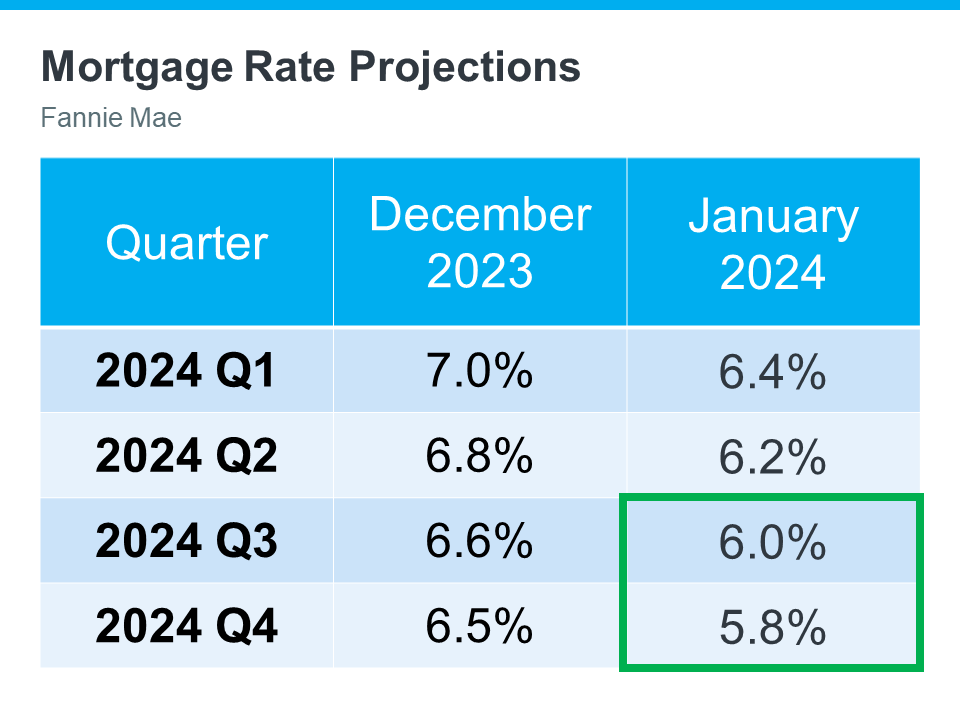

And Baker isn’t the only one saying this is a possibility. The latest Fannie Mae projections also indicate we may see a rate below 6% by the end of this year (see the green box in the chart below):

The chart shows mortgage rate projections for 2024 from Fannie Mae. It includes the one that came out in December, and compares it to the updated 2024 forecast they released just one month later. And if you look closely, you’ll notice the projections are on the way down.

It’s normal for experts to re-forecast as they watch current market trends and the broader economy, but what this shows is experts are feeling confident rates should continue to decline, if inflation cools.

What This Means for You

No one can say for sure what will happen (and by when) – and short-term volatility is to be expected. Don’t let small fluctuations scare you. Focus on the bigger picture.

If you’ve found a home you love in today’s market – especially where finding a home that meets your budget and your needs can be a challenge – it’s not a good idea to try to time the market and wait until rates drop below 6%.

With rates already lower than they were last fall, you have an opportunity in front of you right now. That’s because even a small quarter point dip in rates gives your purchasing power a boost.

Bottom Line

If you wanted to move last year but were holding off hoping rates would fall, now may be the time to act. Let’s connect to get the ball rolling.

Thursday, January 4, 2024

2024 Homeownership Goals

3 Keys To Hitting Your Homeownership Goals in 2024

If buying or selling a home is your goal for 2024, it’s important to understand today’s housing market, know your why, and work with industry experts to bring your homeownership vision for the new year into focus.

Over the last year, the economy had a big impact on the housing market, and likely on your wallet too. That’s why it’s critical to have a clear picture of not just the market today, but also on what you want out of it when you buy or sell a home. Danielle Hale, Chief Economist at Realtor.com, explains:

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, so that you can stay in your home long enough that buying is a sound financial decision.”

Here are a few things to think through as you define your goals for 2024.

1. Know Your Why

You’re dreaming about making a move for a reason – what is it? No matter what’s happening in the market, there are still many compelling reasons to buy a home today. Your needs may have changed in a way your current house can’t address, or you could be ready to step into homeownership for the first time. Use your why and your motivation as a guidepost in partnership with an expert advisor to make sure your move gives you a lasting sense of accomplishment.

2. Figure Out What Your Next Home Needs To Look Like

You know you want to move, but how would you describe your dream home? The number of homes for sale has grown recently, and that could mean more options to choose from when you buy. But overall housing supply is still lower than more normal years in the market, so you’ll have to work closely with a pro to find what you’re looking for. Just be sure to keep your budget in mind as you balance your wants and needs. The better you understand what’s essential and where you can be flexible, the easier it will be to find a home that’s right for you.

3. Determine if You’re Ready To Buy

Getting clear on your budget and available savings is essential before you get too far into the process. Partnering with a local agent and a lender early is the best way to make sure you’re in a good position to buy. This could include planning how much to save for a down payment, getting pre-approved for a home loan, and assessing your current home equity if you’re selling your existing house.

A Professional Will Guide You Through Every Step of the Process

Buying or selling a home takes expertise to navigate. If that feels a bit overwhelming, that’s normal. Don’t let uncertainty hold you back from your goals this year. A trusted expert will help you bridge that gap and give you the facts and advice you need about today’s housing market.

Bottom Line

Let’s connect to plan how to make your homeownership dreams a reality in 2024.

Why I Still Think You Should Buy That House, Even Now.

Invest in Yourself by Owning a Home Are you wondering if it makes sense to buy a home right now? While today’s mortgage rates might seem a...

-

Think Twice Before Waiting for 3% Mortgage Rates Last year, the Federal Reserve took action to try to bring down inflation. In response to...

-

Homeownership Wins in the Long Run Today’s higher mortgage rates , inflationary pressures , and concerns about a potential recession h...

-

Home Price Declines? If you’re following the news today, you may feel a bit unsure about what’s happening with home prices and fear whe...