With Rents on the Rise – Is Now the Time To Buy?

According to recent data from realtor.com, median rental prices have reached their highest point ever recorded in many areas across the country and they are definitely going up in Montgomery County, if you can even find one before it's gone! The report found rents rose by 8.1% from the same time last year. As it notes:

“Beyond simply recovering to pre-pandemic levels, rents across the country are surging. Typically, rents fluctuate less than 1% from month to month. In May and June, rents increased by 3.0% and 3.2% from each month to the next.”

If you’re a renter concerned about rising prices, now may be the time to consider purchasing a home.

Did You Know Monthly Rents Are Higher Than Monthly Mortgage Payments?

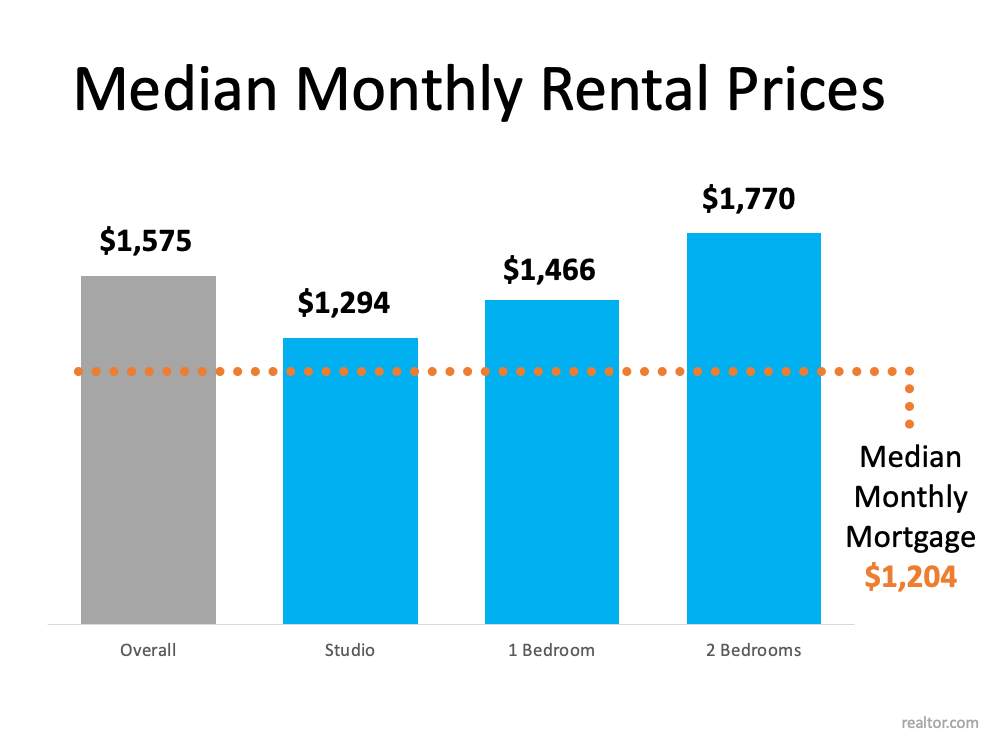

When you weigh your options of whether to buy a home or continue renting, how much you’ll pay each month is likely top of mind. According to the National Association of Realtors (NAR), monthly mortgage payments are rising, but they’re still significantly lower than the typical rental payment. NAR indicates the latest data on homes closed shows the median monthly mortgage payment is $1,204. This is definitely the case now with the rates near historic lows, and while this data is "national averages" if you live in the DMV, you know our average rental price is even higher.

Sticking to national averages for demonstration purposes though, the median national rent is $1,575 according to the most current data provided by realtor.com. In other words, buyers who recently purchased a home locked in a monthly payment that is, on average, $371 lower than what renters pay today (see graph below):

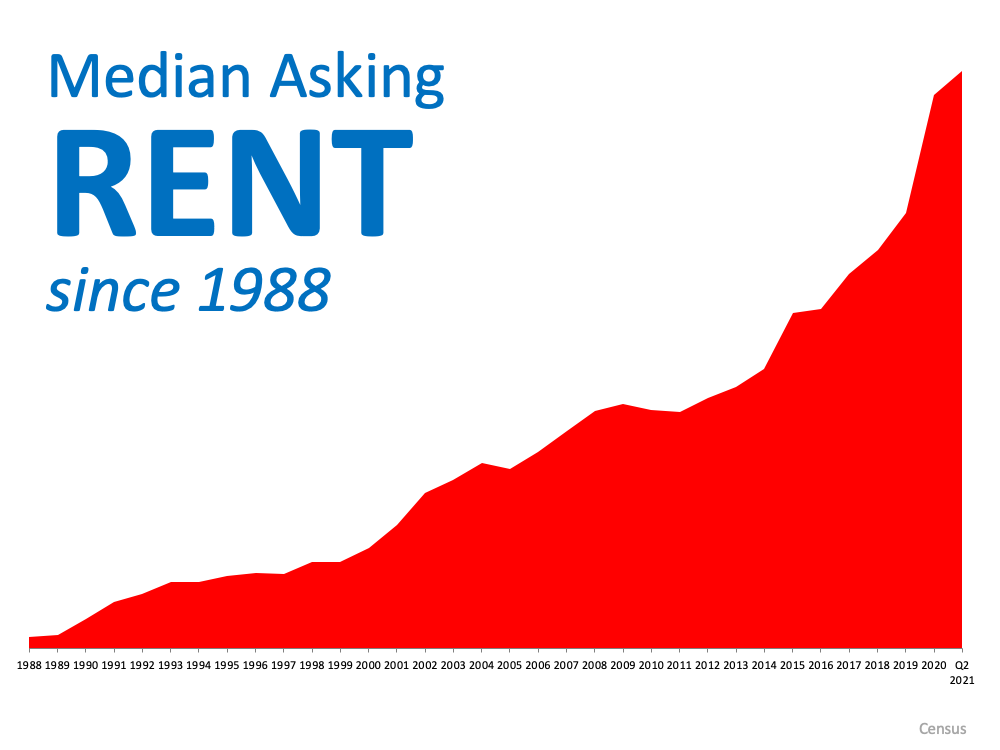

Rents Are Rising Sharply, and They Continue To Increase

The difference in monthly housing costs when comparing renting and homebuying today is significant, but many would-be homebuyers wonder about the future of rental prices. If we look to historical Census data as a reference, the median asking rent has risen consistently since 1988 (see graph below): The rise in rent over time clearly shows one of the major advantages homeownership has over renting: stable housing costs. Think about this for a second because it's maybe the most important factor when you look at overall ongoing cost: Renters face increasing costs every year. When you purchase your home, your mortgage rate is locked in for 30 years, meaning your monthly payment stays the same for the life of the loan. That gives you welcome peace of mind and predictability for many years ahead.

The rise in rent over time clearly shows one of the major advantages homeownership has over renting: stable housing costs. Think about this for a second because it's maybe the most important factor when you look at overall ongoing cost: Renters face increasing costs every year. When you purchase your home, your mortgage rate is locked in for 30 years, meaning your monthly payment stays the same for the life of the loan. That gives you welcome peace of mind and predictability for many years ahead.

The Bottom Line

With rents continuing to rise locally, renters should consider if now is the right time to buy. There are multiple benefits to buying sooner rather than later. Feel free to reach out to discuss your options so you can make the decision that's right for you. Weichert's "All Under One Roof" services mean I have a mortgage advisor on my team who can run the numbers as they apply to you.

No comments:

Post a Comment